owe state taxes ny

You will get a free consultation with one of our expert tax debt attorneys. If you owe less than 20000 of state and IRS tax debts you are often best off handling it yourself.

New York Dtf 960 E Letter Sample 1

Stilt loans are originated by Stilt Inc NMLS1641523 NMLS Consumer Access.

. See what federal tax bracket youre in. How do I apply for an New York State Tax Debt installment agreement over the telephone. Of that 62 percent was levied by schools and 17 percent by counties.

External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. October 1 2021 The onset of the COVID-19 pandemic in March 2020 coupled with the rise in New York individual income tax rates that became effective in April 2021 spurred many individuals to move out of New York and. This is the highest rate in the state.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates which may impact estimated tax payments. In most cases NY State requires a down payment of around 20 before they agree to an IPA. Thats where the state allows you to clear your taxes owed for less than you owe.

Tax refunds could be delayed in 2022. NEWS10 - The New York State Department of Taxation and Finance is urging taxpayers to file on time even if they cant pay owed taxes in full. In fiscal years ending in 2009 local governments and school districts outside of New York City levied 2887 billion in property taxes.

Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. If it does not contact your software company for assistance. The debtors are ranked by the total docketed value of their warrants.

Usually if you got a refund the previous year you should be able to have another one this year as long as you have the same situation. You might owe state taxes because you have a different personal tax situation. You will need to enter your taxpayer identification number and the four-digit pin on your bill.

New York State delinquent taxpayers. You must report EWF benefits when you file your federal and state income tax returns. Once this is released New York State will be able to pursue the money you owe them through various means completely legally.

June 1 2019 1119 AM. New York City Sales Tax. There are a few ways to apply for a payment plan with New York.

I was unemployed in 2020 due to pandemic and only started my new job in March 2021 and obviously my income shot up significantly from 2020. The amount of New York State withholding in Box 11. Your marginal federal income tax rate.

New York can use various types of levies to collect back taxes including the following. If you are e-filing your return your software should prompt you to enter all the information from your Form 1099-G including Box 6. We may have filed the warrants over a period of years but we filed at least one warrant within the last 12 months.

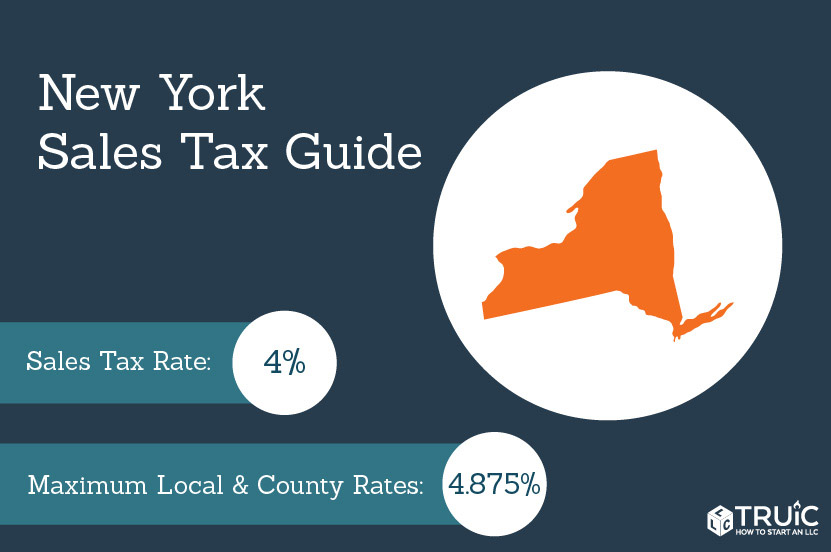

3078 - 3876 in addition to state tax Sales tax. The first effect of a Tax Warrant is to prohibit due back taxes from liquidating their assets. This secure online application allows you to pay by either debit card ACH credit card or checkmoney order.

These are the taxes owed for the 2021 - 2022 filing season. Your 2021 Federal Income Tax Comparison. Generally you will continue to owe New York State income tax on income earned while telecommuting.

The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. Bank levies that last for a 90-day period. To pay your taxes electronically you can do so at the New York State Department of Taxation.

I just filled out my Turbotax filings and am owed Federal taxes but owe 5k in State Income tax to NY. If you owe more than 20000 a tax attorney is recommended. Here are some of the paths frequented by businesses that owe taxes.

When she filed taxes for 2020 Freed discovered she owed New York State 1200 for income taxes on unemployment benefits. Filing late will result in penalties with added interest on unpaid taxes. OH MO TN GA NY NJ NC WI MA VA.

Where you fall within these brackets depends on your filing status and how much you earn annually. With such a high sales tax its no wonder the cost of living in New York City is so high. New York State Tax Quick Facts.

Installment Payment Agreement IPA. Seizure and sale of property at tax auction. The total sales tax in New York City is 8875.

NY Tax Dept. With respect to seizure of property New York State Agents at the Collections and Civil. There is no option to choose Mail in my estiated payment You do not make it clear that to make manual payments one.

You can pay or schedule a payment. The department may offset any money owed to you from a state or federal tax refund to either shorten the duration of your IPA or pay your balance in full. If you do nothing the New York State Tax Department will send your case to collections.

If for any reason the path ahead seems unclear and you owe more than 20000 dont hesitate to drop us a line on our Contact Us page or call us at 888 515-4829. The city also collects a tax of 0375 because it is within the MCTD. How do I owe so much in State Income Taxes NY this year.

Pay personal income tax owed with your return. If you have your bill you can call New York at 518-457-5434. If you do not satisfy your full tax balance or comply with the terms of your IPA we may.

In New York State the property tax is a local tax raised and spent locally to finance local governments and public schools. Generally these tax cases are handled on a case-by-case basis. A tax warrant also known as a tax lien is the equivalent to a money judgment for New York States tax department.

Therefore unpaid trust fund taxes are a serious matter to New York. The case is assigned to the collections area and eventually may be assigned to an. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants.

Below are the NYC tax rates for Tax Year 2021 which youll pay on the tax return you file by April 2022. On top of the state sales tax New York City has a sales tax of 45. Said file on time anyway.

New York City income tax rates are 3078 3762 3819 and 3876 depending on which bracket you are in. Youll continue to accrue penalty and interest on any unpaid balance for the duration of your IPA. Pay income tax through Online Services regardless of how you file your return.

Levies on third parties such as customers or tenants. New York State uses the IRSs Financial Standards as a guide for determining allowable living expenses. Fortunately New York is a bit more flexible than the IRS.

The maximum weekly benefit at 504 dollars is already low especially for those of us living in New York City so taxing on top of that is just cruel frankly said Freed the Executive Director of ExtendPUA an. If you owe taxes to the New York State you may qualify for an NYS Offer in Compromise OIC.

New York Dtf 973 Letter Sample 1

New York Dtf 960 E Letter Sample 2

Form It 201 Resident Income Tax Return The New York State

Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com

Certificate Of Authority New York Sales Tax Truic

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan S Notes Blog

New York Dtf 973 Letter Sample 1

Sales Tax Conflicts Where Two States Tax The Same Transaction

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

Nys Tax Department 7 Reasons You Owe Taxes Ny Tax Help

Nys Tax Department 7 Reasons You Owe Taxes Ny Tax Help

Where S My New York Ny State Tax Refund Ny Tax Bracket

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)